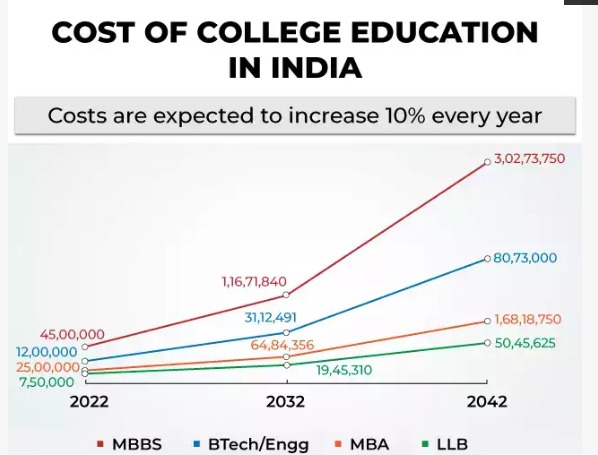

India, in recent years, has emerged as a central education hub as Indian and international students are flooding Indian colleges, resulting in the rapid growth of colleges. However, with rising inflation, education and living costs have increased, making it economically draining for students to pursue their Higher Education. According to a National Sample Survey Office (NSSO) report, the average annual private expenditure incurred towards general education (from primary level to post graduation and above) has grown by 175% to Rs6,788 per head during 2008 -14. Alongside this, the annual cost of higher education has jumped by a massive 96% to Rs62,841 per student. Most of these surveyed households, rural and urban, are spending a significant portion of their money on education. Various education Counselling websites such as Rahul Jain ReviewAdda are also pushing this growth by arranging colleges for students.

Solutions To Consider

College students often face the daunting task of independently navigating the financial aspects of pursuing higher education as parents are only sometimes aware of the latest development in the sector and sources of finances available for their child. However, with the proper guidance and research, affordable options are available to help make their education finances a cakewalk.

One of the first steps in finding affordable colleges and navigating the financial aid process is conducting thorough research. Students should look for colleges and universities that offer scholarships, grants, and financial aid programs. Many institutions have specific programs that cater to students who may not be able to afford tuition, making it easier for them to achieve their academic goals.

Like many other countries, India provides various college education financing options. Education loans are a common funding source that multiple banks and financial institutions offer. Personal savings and part-time jobs while studying can also help to finance a college education. Families can also choose traditional methods such as setting aside a portion of their monthly income or investing in a long-term savings plan.

Students can also explore alternative options for financing their education, such as part-time work or internships. Many companies offer programs that assist with tuition expenses for employees. Additionally, online courses can provide more affordable options for completing prerequisite courses before transferring to a more prominent university.

You Are Not Alone

Navigating the financial aid process can be overwhelming for students, but help is available. Financial aid offices at prospective colleges and universities can guide the different types of aid available, such as grants, loans, and work-study programs. In addition, seeking help from startups like Rahul Jain ReviewAdda and CollegeDunia can benefit students who need help with their options. These websites not just inform students about finance options but also provide them with a guide to the perfect college.

In the end, it is essential for students not to let finances deter them from pursuing higher education. With some research, guidance, and creative thinking, affordable options are available to help make college dreams a reality.

To get more updates, Follow us on Facebook, Twitter and Instagram. You can also join our Telegram Channel