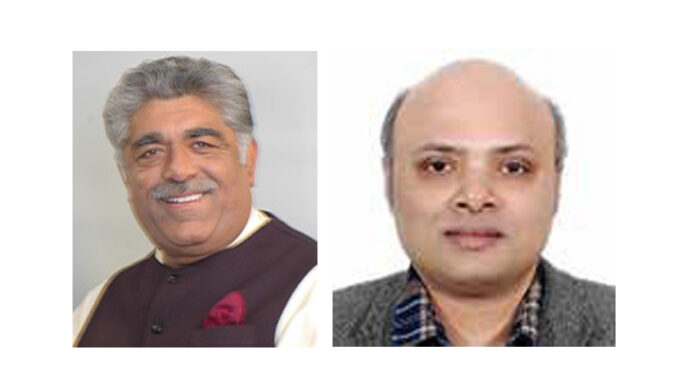

Vipin Malik, Chairman and Mentor, Infomerics Ratings.

Sankhanath Bandyopadhyay, Economist, Infomerics Ratings.

As broadly expected, in the latest FOMC meet, the Fed has kept rate unchanged, however, what needs to be seen how growth, inflation and unemployment projections should be realigned as the Fed seems to have adopted a dovish stance with 3 cuts projected in 2024.

The increase in the March’24 projection of long-run Federal Funds Rate(FFR) compared to Dec’23 as well as the upward revision of the PCE inflation in 2024 from 2.4 to 2.6 is a credible signal to the market (from 3.6 to 3.9 in 2025, from 2.1 to 3.9 in 2026) which is aligned with Fed’s commitment towards achieving durable disinflation towards 2%. Ceteris Paribus, the July’24 is expected of the start of the month of the much-awaited three rate cuts, but still sketchy.

Interestingly, the debt-GDP ratio in US is high and high interest are taking a toll on business and real economic activity, which warrants a dovish tone and the Fed forecasting 3 rate cuts in 2024. Moreover, real interest rates have inched up, given the sustained pace of upward momentum of FFR, which though have certain impact on inflation with a lag effect, but at the same time has dampened the real purchasing power. For instance, the recent uptick in the 10-year real interest rate can be checked from the FRED Economic data, that increased from 1.68 per cent to almost at 2 per cent in March 2024; here from the link: https://fred.stlouisfed.org/series/REAINTRATREARAT10Y.

The Fed is trying to reach gradually towards possibly an ideal Phillips curve situation with roughly ‘zero’ rate of unemployment (the labour market is still reasonably strong) and the desired 2 per cent rate of target inflation (the buzz that is hovering all around in the name of the “soft landing”). Nevertheless, as mentioned previously, the stringent real rates indicates that the monetary policy is becoming effectively much “tight” than apparently seems to be. For instance, the hype Buy Now Pay later (BNPL) failed largely showing consumers face heat and credit card bills giving pain). The only issue is, the Monetary policy comes with lag, and if the CPI starts rebound in the other direction from the current roughly around 3%, this would not be a sustainable durable disinflation path, and force Fed to maintain status quo. Fed wants to ensure if the direction is towards their desired 2% a strict benchmark. Nevertheless, globally stocks have rallied in the expectation of a soft-landing and an anticipated rate softening in June’24.

Certain other developments have taken place, notable the ending of the era of the negative interest rates by Bank of Japan (BoJ) (for the first time in 17 years) as well as the yield curve control (YCC) and ETF purchase, after a survey of the wage data. Short-term rates of near zero will now be guided to “around 0 to 0.1” per cent.

While India’s macroprudential policies remain strong, there are certain stress on Indian rupee due to such developments. The USD/INR has improved a bit towards 83.34 compared to 83.42 compared to its previous data read. The upward movement of the USD/CNY has also taken a toll on the emerging market (EM) currencies including rupee.

Broadly, market expects a rate softening from Fed in June’24, nevertheless, Fed is overcautious and willing to ensure that inflation moves towards 2 per cent target in a sustained basis. Interestingly, the dovishness from CBs have been reflected recently, for instance, the Swiss National Bank (SNB) has reduced policy rate by 25 bps recently, as well as the Bank of England (BOE) has shown the similar bearing. Interestingly, one member preferred to reduce Bank Rate by 0.25 percentage points, to 5%.